Methodology Framework

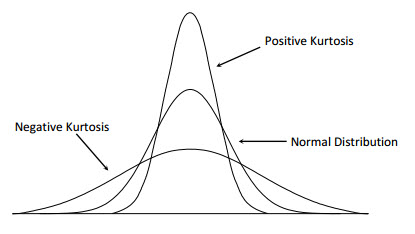

The effects of noise on the world, and our views of the world, are profound. Noise in the sense of a large number of small events is often a casual factor much more powerful than a small number of large events can be. Noise makes trading in financial markets possible, and thus allows us to observe prices for financial assets. Noise causes markets to be somewhat inefficient, but often prevents us from taking advantage of inefficiencies. Noise in the form of uncertainty about future tastes and technology by sector causes business cycles and makes them highly resistant to improvement through government intervention. Noise in the form of uncertainty about what relative prices would be with other exchange rates makes us think incorrectly that changes in exchange rates or inflation rates cause changes in trade or investment flows or economic activity. Most generally, noise makes it very difficult to test either practical or academic theories about the way that financial or economic markets work. We are forced to act largely in the dark.

The most important principal of our Methodology is to take decisions based on accurate infomation.

Information Asymmetry Model

How the thresholds are calculated?

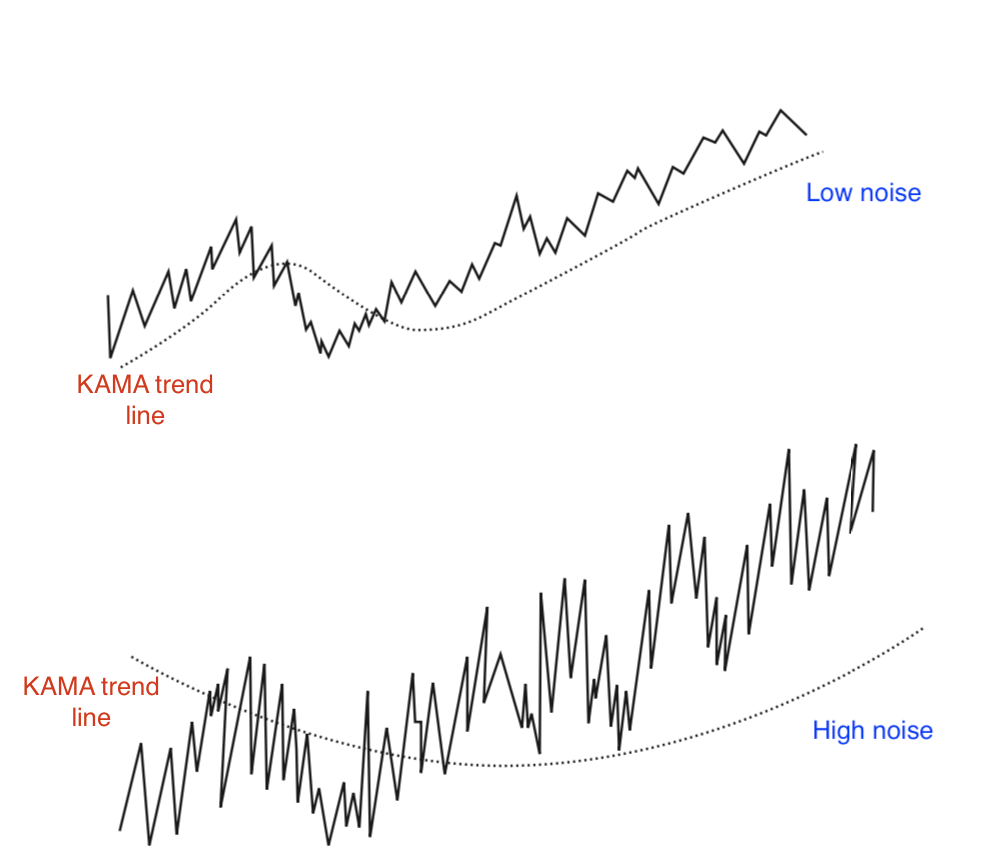

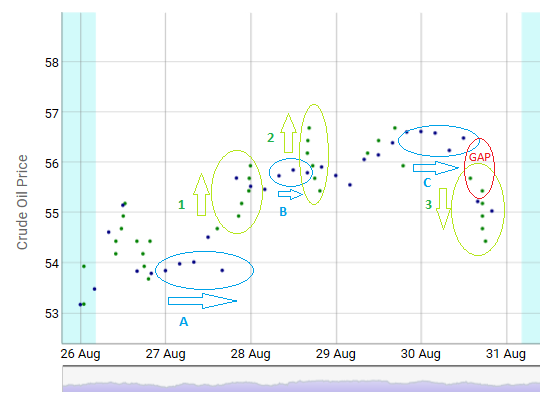

This is the most important phase of our methodology. This phase using linear optimization tries to find the optimum solution based on the idea that we must exclude the sampling during horizontal price movements and considering only the periods with vertical movements. The optimum solution is different for each financial asset and it is depending from the asset structure, the past volatility and from the trading plan (long-term or short term) we want to build.(In Statistics section there two real trading cases, one with medium-to-long term strategy and another one with short term strategy).

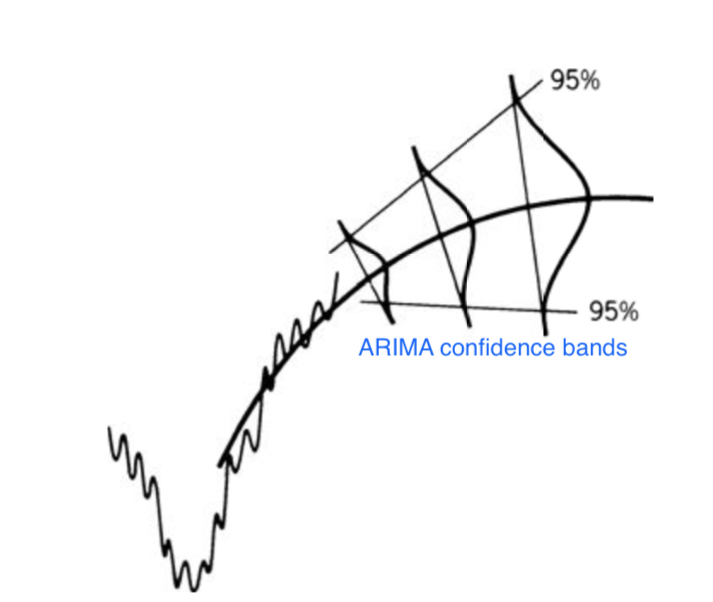

Algorithmic Model Description

n-periods.

Information-driven Sampling vs Time Series Sampling Crude Oil